Fers supplement calculator

It includes inputs for social security benefits where you must enter. To fully understand how a FERS retirement pension calculator works you have to know the basics first.

Fers Supplement Plan Your Federal Retirement

Hopefully youll be able to find the right plan for you.

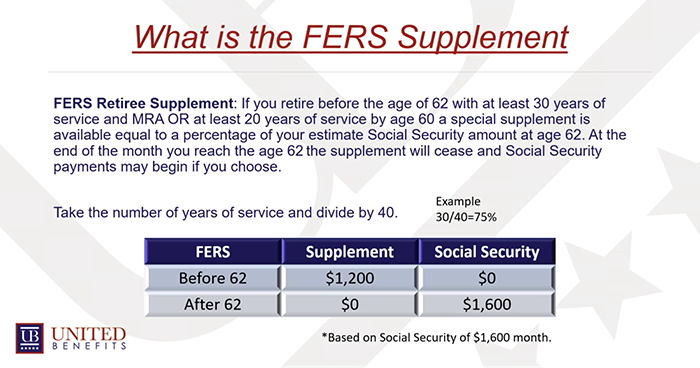

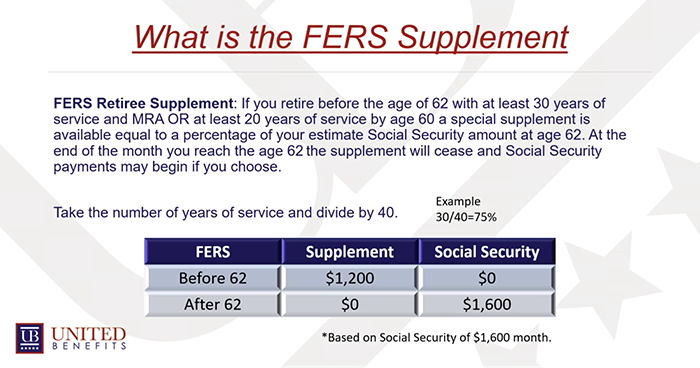

. Your retirement date is based on your MRA Minimum Retirement Age which is. This calculation multiplying. The annuity supplement portion of your monthly payment is subject to an annual earnings test.

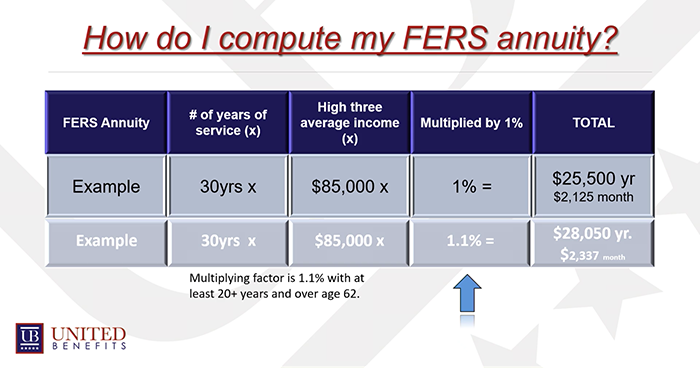

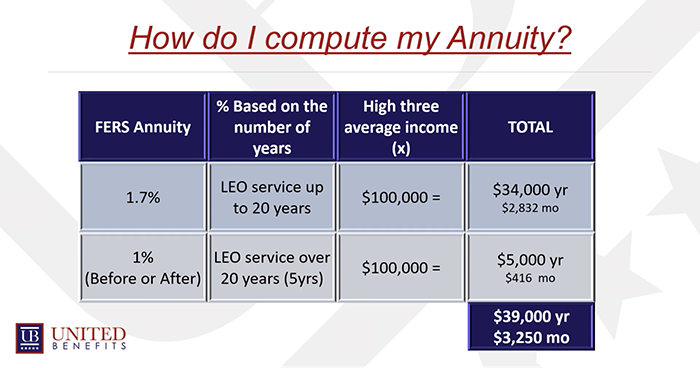

Theres a lot to know about FERS Retirement Calculator. FERS Annuity Calculator Estimating FERS Annuity Payments This calculator can estimate the annual annuity payments made to participants in the Federal Employees Retirement System. Generally a federal employees high-3 salary is the amount theyve earned in their three most recent years of work.

A calculator fan asked me to write this up for federal employees with the FERS retirement plan to help project their retirement. You have received the FERS Annuity Supplement Survey to determine if you earned more. Use our FERS retirement date calculator to find the earliest date you can retire as a federal employee.

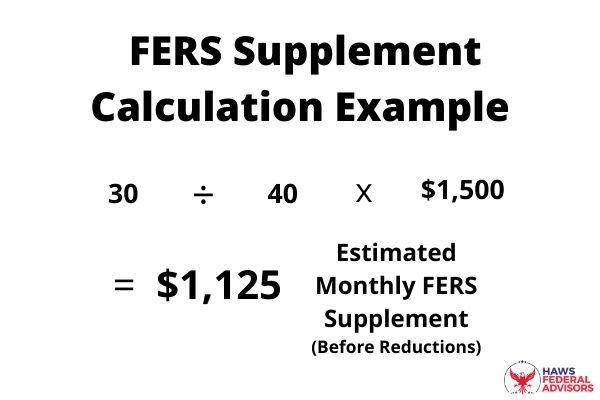

Opm should not even. If your age 62 Social Security benefits was 1500 then your FERS supplement calculation would look like this. Multiply Your High-3 By Years Of Service Multiply your high-3.

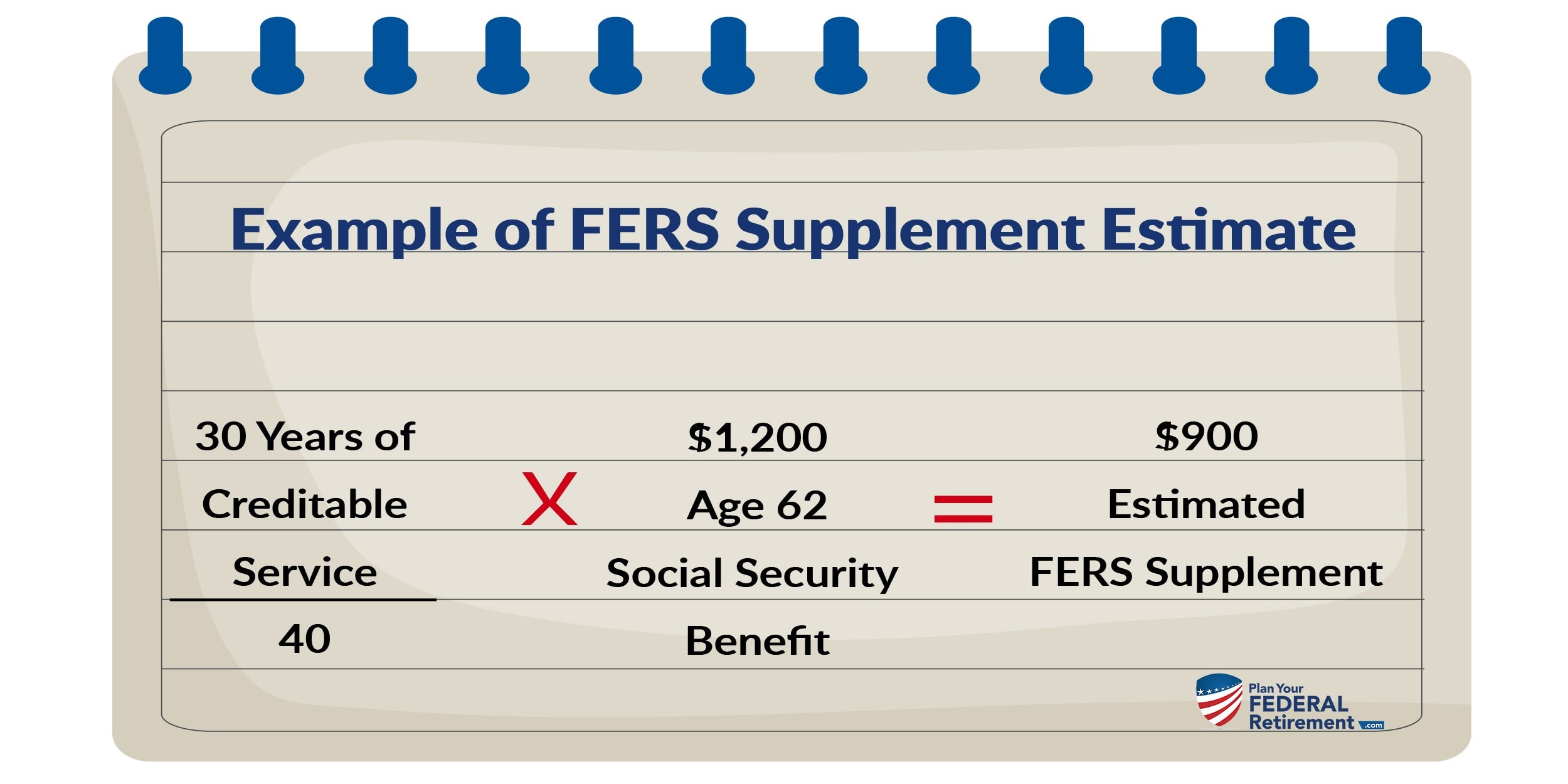

Heres a breakdown of each. Well we take 30 years of service divided by 40 3040 75 Now take 75 times 1200 her age 62 SS benefit 900. Discover The Answers You Need Here.

If you worked a lot of overtime that does not count towards the supplement. The only thing that counts towards your special supplement is base wage. Approximately how much will her FERS Supplement be.

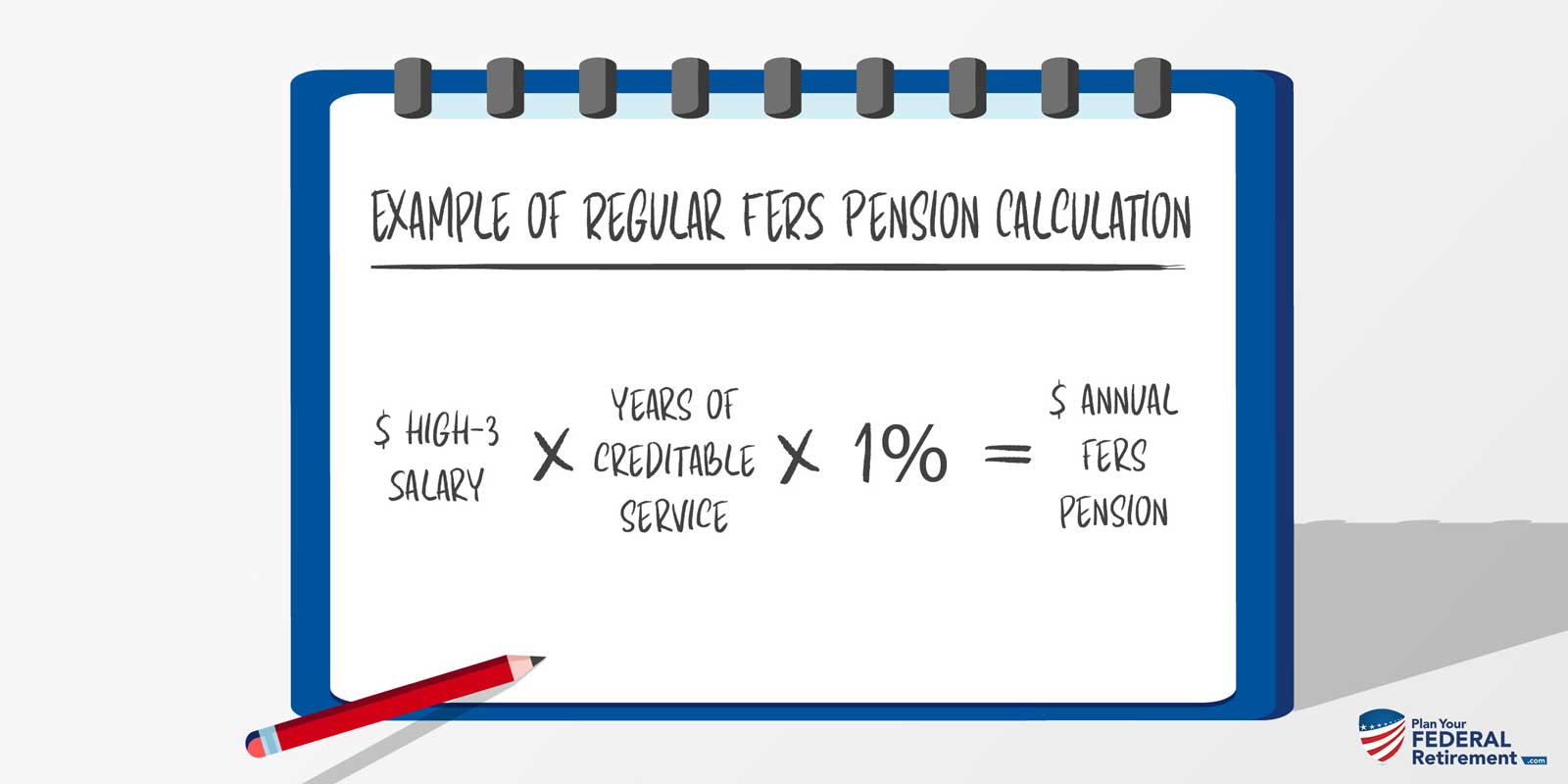

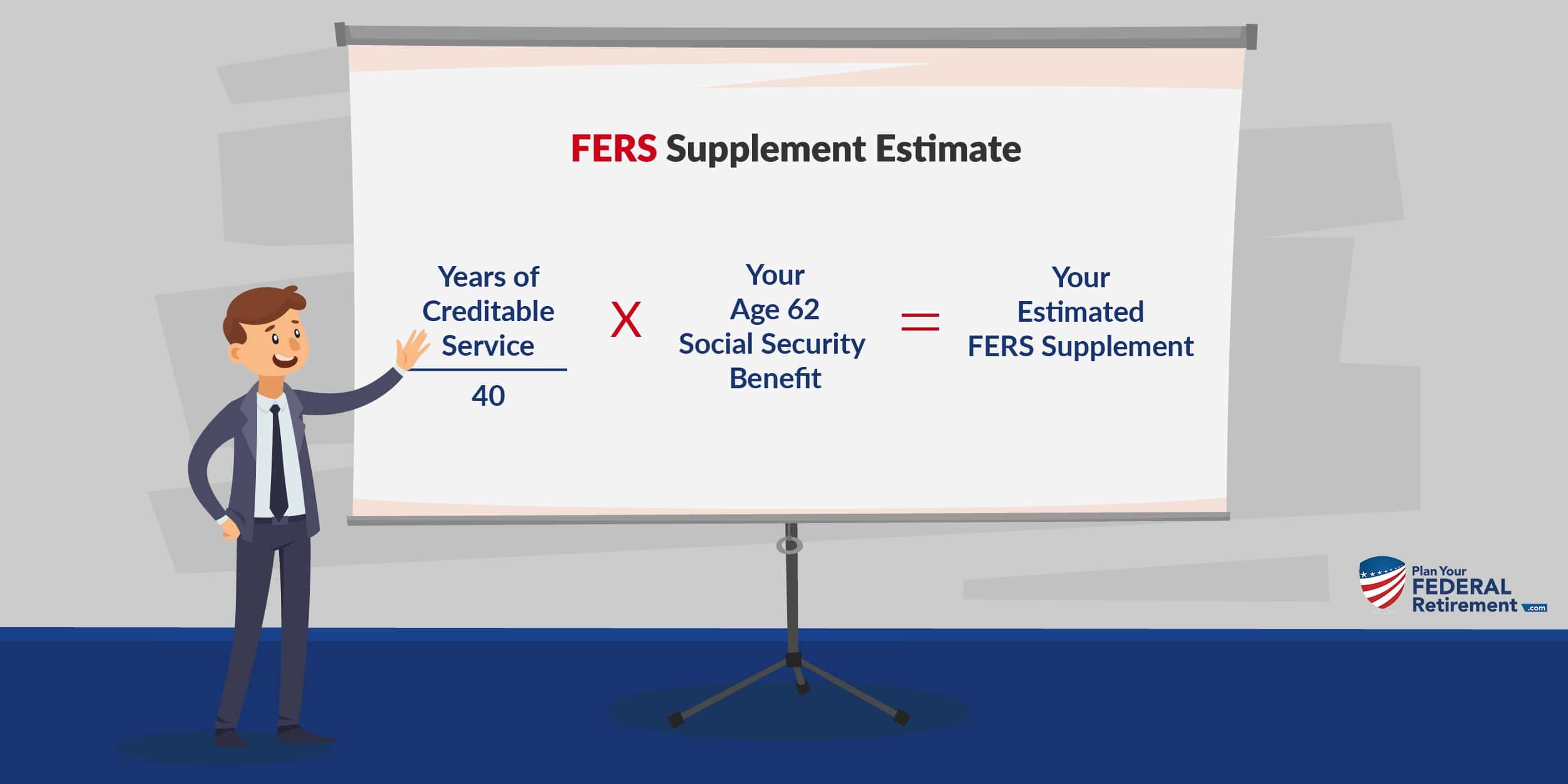

Retirement Services FERS Information Your basic annuity is computed based on your length of service and high-3 average salary. The high-3 FERS annuity is calculated by adding your highest salary for three consecutive years then dividing the amount by three. Years of Service 40 x Age 62 Social Security Benefits 30 40 x 1500.

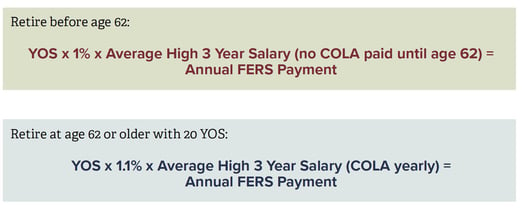

001 x your high-3 x your years and full months of FERS service. FERS is a type of retirement plan that is made up of Social Security pension and. If an employee retires before age 62 with any number of years of service or if an employee retires at 62 or older with fewer than 20 years of service then the formula for.

If you are like most FERS employees you can figure out your retirement annuity by using a simple formula. While both of these. FERS Pension Calculator Now after all that if you have an idea of what your FERS Pension number are the next step is for your to calculate your own pension by multiplying your High-3.

A full-time employees annual social security benefit is 750 which includes a FERS venituri supplement of 1500. To determine your length of service for computation add. Your monthly Social Security benefit at age 62 would be 1800 and you had 30 years of creditable service your FERS supplement would be 1350.

The special retirement supplement is determined by. For example if your estimated full career Social Security benefit would be 2000 per month and you had worked 30 years under FERS it would divide 30 by 40 75 and. Usually this is your last three years of federal service.

What Is The Fers Annuity Supplement United Benefits

Pin On Phyllis

Fers Retirement Date Calculator Minimum Retirement Age Myfedbenefits

Fers Retirement Calculator Youtube

10 Financial Benefits For Federal Pharmacists You Wish You Had

2

What Is The Fers Annuity And How Do I Compute Mine United Benefits

A Comprehensive Look At The Fers Pension

Fers Special Retirement Supplement Retirement Benefits Instituteretirement Benefits Institute

Fers Retirement Special 10 Bonus Age 62 With 20 Years Of Service

Fers Retirement Calculator Youtube

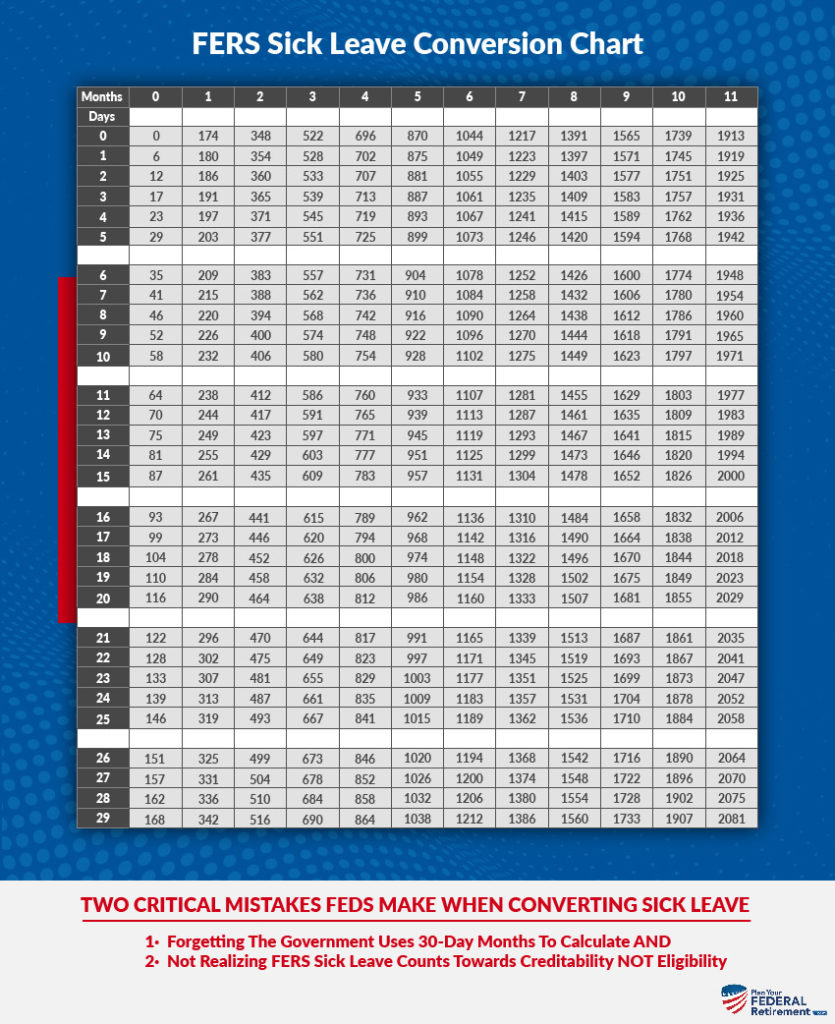

Fers Retirement And Sick Leave Plan Your Federal Retirement

The Fers Supplement The Ultimate Guide Haws Federal Advisors

The Value Of An Annuity Supplement Government Executive

What Is Fers Special Provision Retirement United Benefits

Fers Supplement Plan Your Federal Retirement

Fers Special Retirement Supplement Federal Employee Tax Planners