2021 marginal brackets

Filing Status Taxable Income Marginal. Generally the more you earn the more likely you should use marginal rates as your measurement tool.

The Mystockoptions Blog Tax Planning

An individuals tax liability gradually increases as their.

. If you find your income falls into one of the lower brackets you can. Tax Rates for the Tax Years 2021 and 2022 by Filing Status. 2019 2021 Federal tax brackets Marginal tax rates.

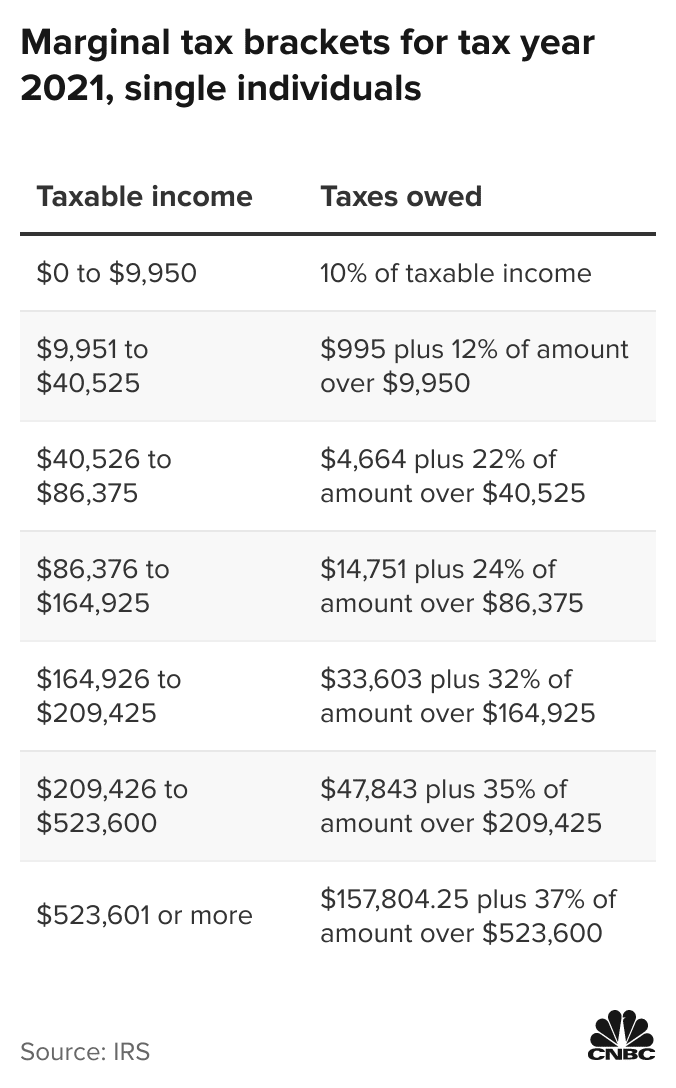

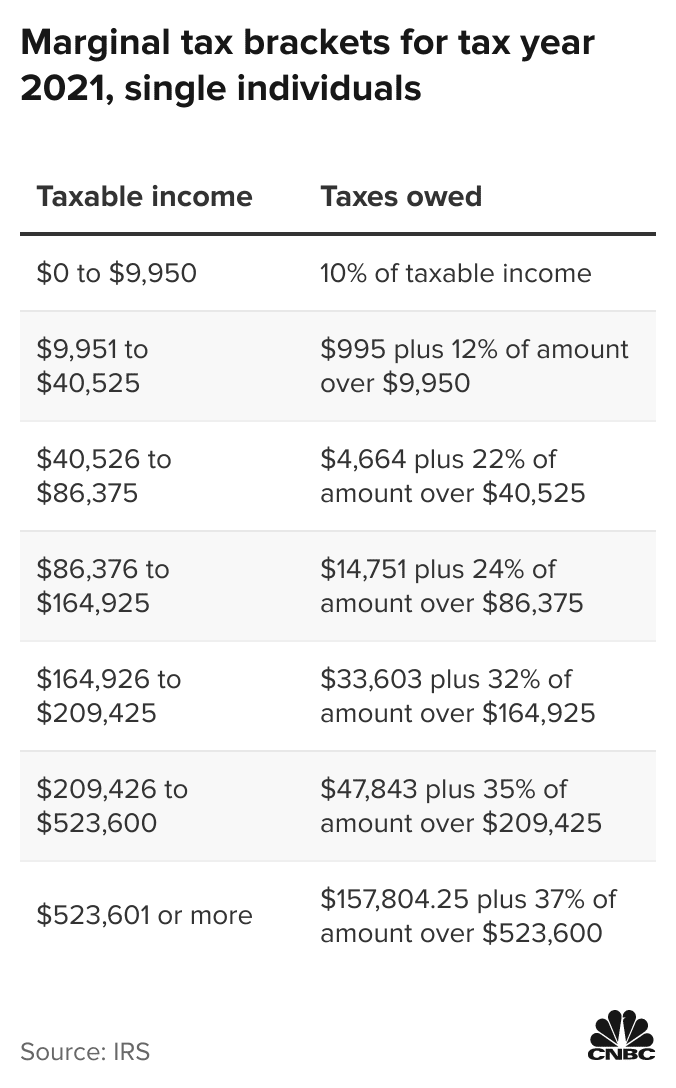

2021 Marginal Tax Brackets Your marginal tax bracket determines how much of the earnings from savings and investments you get to keep after taxes. For 2021 the 22 tax bracket for singles went from 40526 to 86375 while the same rate applied to head-of-household filers with taxable income from 54201 to 86350. 2022 Federal Income Tax Brackets and Rates.

Read my disclosure policy. Tax rates are applied through a five-tier setup that starts at 10 percent for those who make less than 9276 and works its way up to 33 percent for those earning 190150 or more. 10 12 22 24 32 35 and 37.

Imposes an income tax by using progressive rates. Your total income and your tax-filing classification. For tax year 2021 the top tax rate remains 37 for individual single taxpayers with incomes greater than 523600 628300 for married couples filing jointly.

More From GOBankingRates These Are the Best Banks of 2021 Did Yours Make the. Your bracket depends on your taxable income and filing status. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

For the 2021 tax year there. There are seven federal tax brackets for the 2021 tax year. Ad Compare Your 2022 Tax Bracket vs.

Your 2021 Tax Bracket To See Whats Been Adjusted. 2021 Federal Income Tax Brackets Your federal income tax bracket is determined by two factors. For the tax year 2021 youd pay 22 on income over 40525.

Tax rates are applied through a five-tier setup that starts at 10 percent for those who make less than 9276 and works its way up to 33 percent for those earning 190150 or more. 29 rows Individual Tax Rate Schedules for 2021. Discover Helpful Information And Resources On Taxes From AARP.

Below are the four individual tax rate. The 12 rate would be applied to your income that falls between 9950 and 40525 and the 10 rate is applied to. The 2021 maximum Earned Income Credit will be 6728 in 2021 up from 6660 in 2020.

This post may contain affiliate links. The United States federal tax laws follow a.

2021 Taxes For Retirees Explained Cardinal Guide

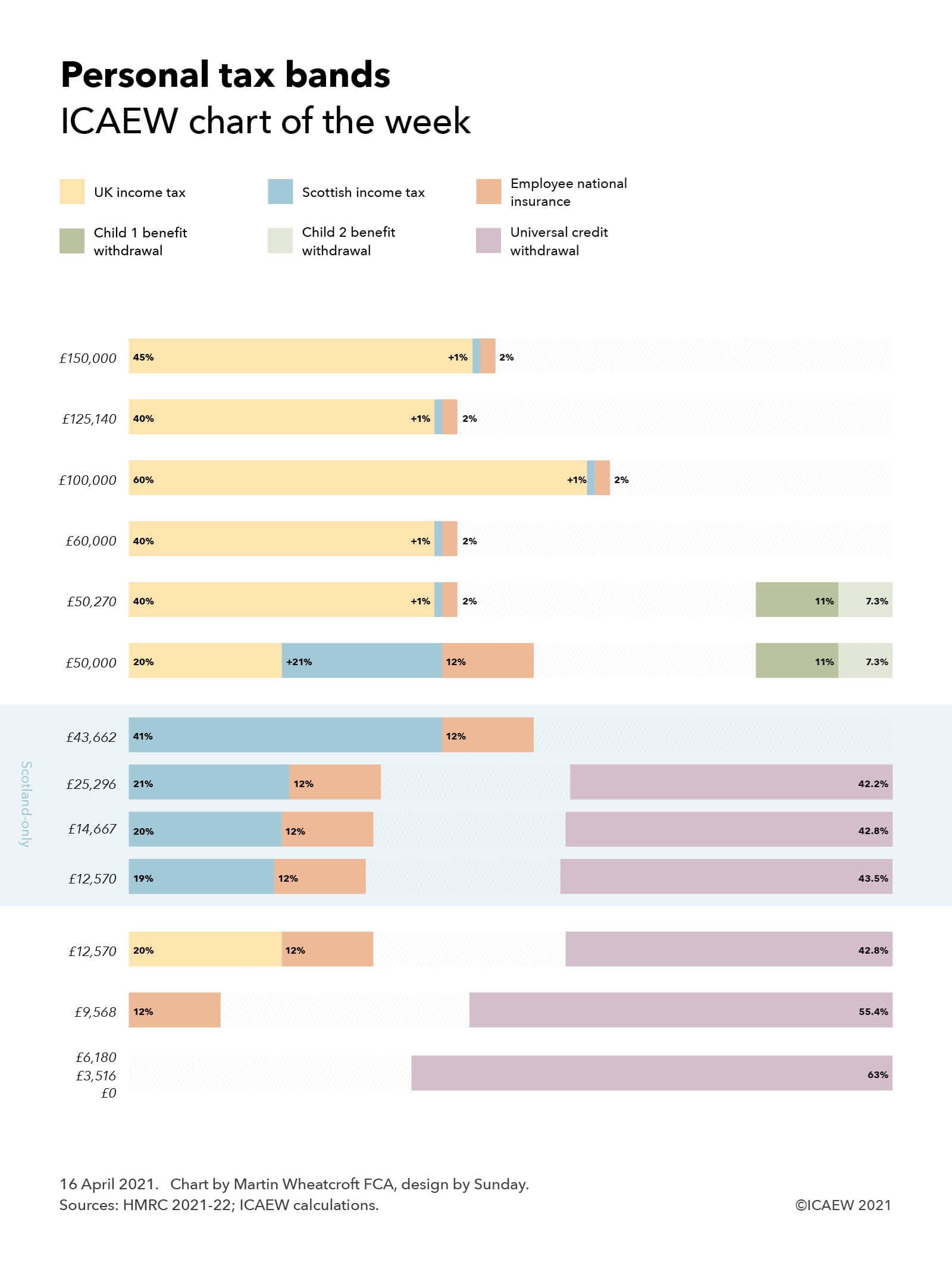

Chart Of The Week Personal Tax Bands Icaew

Marginal Tax Rate Using Excel Youtube

7ipnlkfmi0gimm

Taxtips Ca Ontario 2020 2021 Personal Income Tax Rates

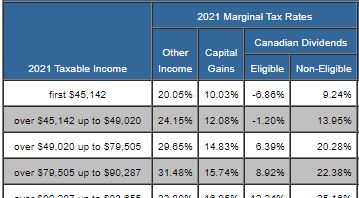

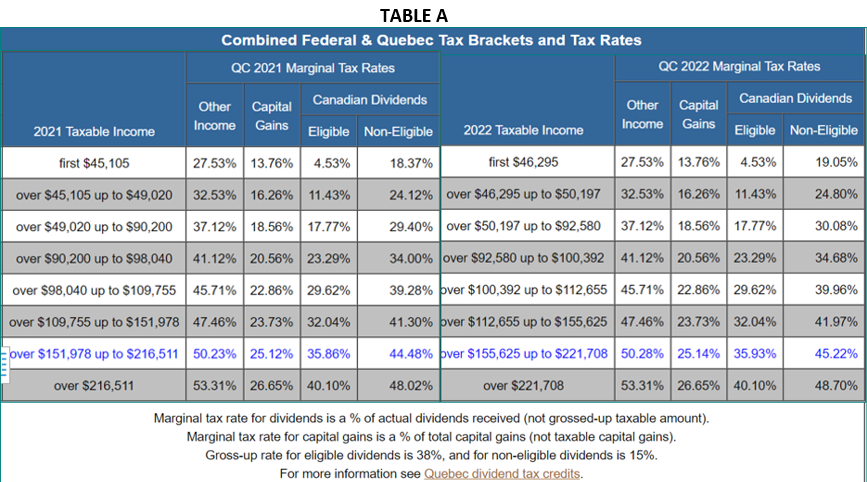

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

Liquidity Conditions And Monetary Policy Operations From 28 July To 2 November 2021

2021 Tax Rate Card Dr Johnson Financial Services

Marginal Tax Rate Formula Definition Investinganswers

2022 Marginal Tax Rates Federal Income Tax Brackets Pay Less Taxes

Liquidity Conditions And Monetary Policy Operations From 28 July To 2 November 2021

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

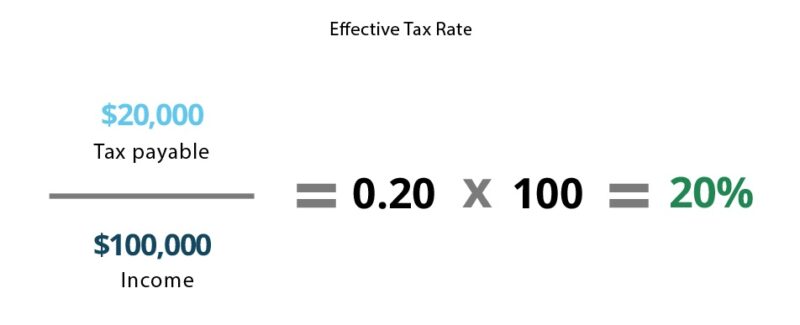

What S The Difference Between Effective Tax Rate And Marginal Tax Bracket

Solved Please Answer Clearly Course Hero

Ava Has Asked You To Help Prepare Her 2021 Personal Chegg Com

Legislature Seeks Huge Tax And Spending Hikes In Next Ny Budget Empire Center For Public Policy

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill